A New Way to Churn Out Cheap LED Lighting

A startup in California has developed a manufacturing technique that could substantially cut the cost of LED lightbulbs—a more energy-efficient type of lighting.

LEDs are conventionally made on a relatively costly substrate of silicon carbide or sapphire. Bridgelux has come up a new process takes advantage of existing fabrication machines used to make silicon computer chips, potentially cutting LED production costs by 75 percent, according to the company.

Despite their higher efficiencies and longer life, few homes and businesses use LED lighting—largely because of the initial cost. An LED chip makes up 30 to 60 percent of a commercial LED lightbulb. Electronic control circuits and heat management components take up the rest. So for a 60-watt equivalent bulb that costs $40, Bridgelux’s technology could bring the cost down by $9 to $18. Integrating the light chip with the electronics might further reduce costs.

LEDs made with the new technique produce 135 lumens for each watt of power. The U.S. Department of Energy’s Lighting Technology Roadmap calls for an efficiency of 150 lumens per watt by 2012. Some LED makers, such as Cree, in Durham, North Carolina, already sell LED lamps with efficiencies in that range. In contrast, incandescent bulbs emit around 15 lumens per watt, and fluorescent lightbulbs emit 50 to 100 lumens per watt.

Will higher oil prices lead to a recession? (Oil Drum)

The idea that high oil prices cause recessions shouldn’t be any surprise to those who have been following my writings, those of Dave Murphy, or those of Jeff Rubin. Last month, though, the Wall Street Journal finally decided to mention the idea to its readers, in an article called “Rising Oil Prices Raise the Specter Of a Double Dip“. The quote they highlight as a “call out” is

When consumers spend more at the pump, they often cut back on discretionary purchases.

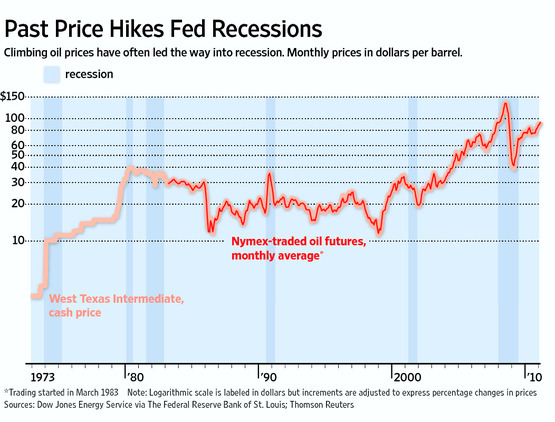

The WSJ shows this graph, linking oil price hikes to recessions:

Figure 1. Wall Street Journal graphic showing connection between oil price rise and recession.A Financial Times blog by Gavyn Davies says something very similar:Each of the last five major downturns in global economic activity has been immediately preceded by a major spike in oil prices. Sometimes (e.g. in the 1970s and in 1990), the surge in oil prices has been due to supply restrictions, triggered by OPEC or by war in the Middle East. Other times (e.g. in 2008), it has been due to rapid growth in the demand for oil.

But in both cases the contractionary effects of higher energy prices have eventually proven too much for the world economy to shrug off.

In this post, I explain what the WSJ and Financial Times articles are missing regarding the connection between oil and the economy. I also explain how the inability of oil prices to rise very far suggests that the downslope may be considerably steeper than most models based only on the Hubbert curve would predict.

As global carbon-trading market stumbles, investors think locally

Vibhav Nuwal was once an enthusiastic supporter of the global carbon market. The Indian-born banker started in September 2009 to develop carbon credits, targeted at investors in Europe and Japan, for Mumbai-based private-equity fund Managing Emissions. Less than a year later, he quit his job, convinced that the United Nations’ failure to broker a global agreement to reduce greenhouse-gas emissions meant that the carbon credit market was effectively dead.

Now, Nuwal, 32, has set up a business helping companies that earn incentives from renewable-energy projects under a new Indian government program. Nuwal says that in the absence of a global consensus, investors are more likely to channel funds into incentive programs in local markets such as India, where they can make three times as much as they do selling credits under the global, U.N.-sponsored plan.

“There is a base being built for a really strong local economy around this,” says Nuwal, a former J.P. Morgan Chase investment banker. “Carbon is getting more and more difficult. A significant amount of the business that is done in the carbon space should shift.”

Nuwal’s decision is one more sign that the consensus reached 14 years ago by 193 nations and the European Union in Kyoto, Japan, may have fractured beyond repair. The plan, which introduced greenhouse-gas restrictions to support a global carbon market, is breaking down as the United States and China grapple over how, when and to what extent they can reduce pollution.

Brazil needs to unblock climate talks: Bill Clinton

US ex-president Bill Clinton urged Brazil to push to get global climate change talks unblocked by getting key trade partners, the United States and China, to curb greenhouse gas emissions.

“You cannot create a sustainable future for Brazil alone; you have got to convince enough other greenhouse gas emitters, including the US and China, your two biggest trading partners, to go with you on this,” said Clinton, in a speech to Brazilian business executives in this sweltering city in the heart of the country’s Amazon basin region.

Brazil “can build on the success that you have had, if you can solve some of the difficult problems in a way that the people of Brazil feel good about… you can break the barrier that kept us from getting an agreement in Copenhagen,” Clinton added.

The former US president lauded Brazil’s ability to curb by 75 percent its deforestation of the Amazon, which made the country at one point a leading contributor to global warming.

Talks in Cancun last November 28-December 11 yielded a rallying call to cap warming to two degrees Celsius (3.6 Fahrenheit) but split badly over the future of the UNFCCC’s Kyoto Protocol, whose first round of emissions-cutting pledges expires at the end of next year.

Senate to vote on proposal to block EPA climate rules

"While House Republicans have garnered most of the attention when it comes to blocking EPA climate regulations, all eyes will turn to the Senate this week.

Three amendments that would limit the Environmental Protection Agency’s ability to regulate greenhouse gas emissions are expected to come up on the Senate floor this week during consideration of small business legislation.

Democrats are planning to first hold a vote on a less stringent amendment offered by Sen. Max Baucus (D-Mont.) that would exempt agriculture from EPA’s climate rules.

At a leadership meeting Monday, top lawmakers will then determine when two other amendments will be considered, including a Republican proposal to permanently eliminate EPA’s authority to regulate greenhouse gas emissions from stationary sources like power plants and refineries.

The amendment, which was offered by Senate Minority Leader Mitch McConnell (R-Ky.), is based on legislation authored by Sen. James Inhofe (R-Okla.). A companion version of the bill

passed a key House committee earlier this month and is expected to come up for a vote on the House floor in the coming weeks.

No comments:

Post a Comment